Weekly Property Pulse

Cameron Fisher | 19th January, 2014

Significant drop in Victorian first home buyers

As puzzling as it appears, first home buyers are trending out the Victorian market place at an astounding rate. Figures released by the ABS Housing Finance Data shows that a mere 12.2% of approved loans were to first home buyers in November 2013. When comparing the 20 year average of 21.4% and following on from October which recorded the lowest percentage of first home buyers in 20 years.

“From a raw numbers perspective, the last time there were fewer than 1,691 of first home buyers recorded in November was in 1991.” Said Robert Larocca, RP Data Victoria Housing Market Specialist.

“It is now 16 consecutive months that the proportion has been lower than the long-term average. The proportion rose in November but only because the number of non-first home buyers fell to a greater extent.”

“The reason this a perplexing issue is because Melbourne dwelling prices are still not at a nominal peak and interest rates are at historical lows. When prices last peaked in October 2010 around 18 per cent of loans were given to first home buyers. At the peak of cycle before that, in 2007, it was around 21 per cent. Prices alone cannot be the reason.” Mr Larocca added.

A more practical reason for first home buyers being squeezed out of the market may be directly related to the number of investors purchasing property at the highest rate seen in over 10 years.

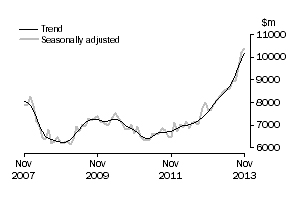

According to ABIS, the value of loans to investors was up 35 % on the same month in 2012 which was the fastest growth since 2003. In New South Wales alone, the increase was over 45 %.

I believe this rapid increase of investor sentiment in the property market is a promising sign that property prices will continue to increase across the board for the major capital cities throughout the first half of 2014 especially as the demand for housing continues to be driven by our increasing population and record low interest rates.

Investment Housing – Total (Source: ABS)

Leave a Reply